Bonds.com:

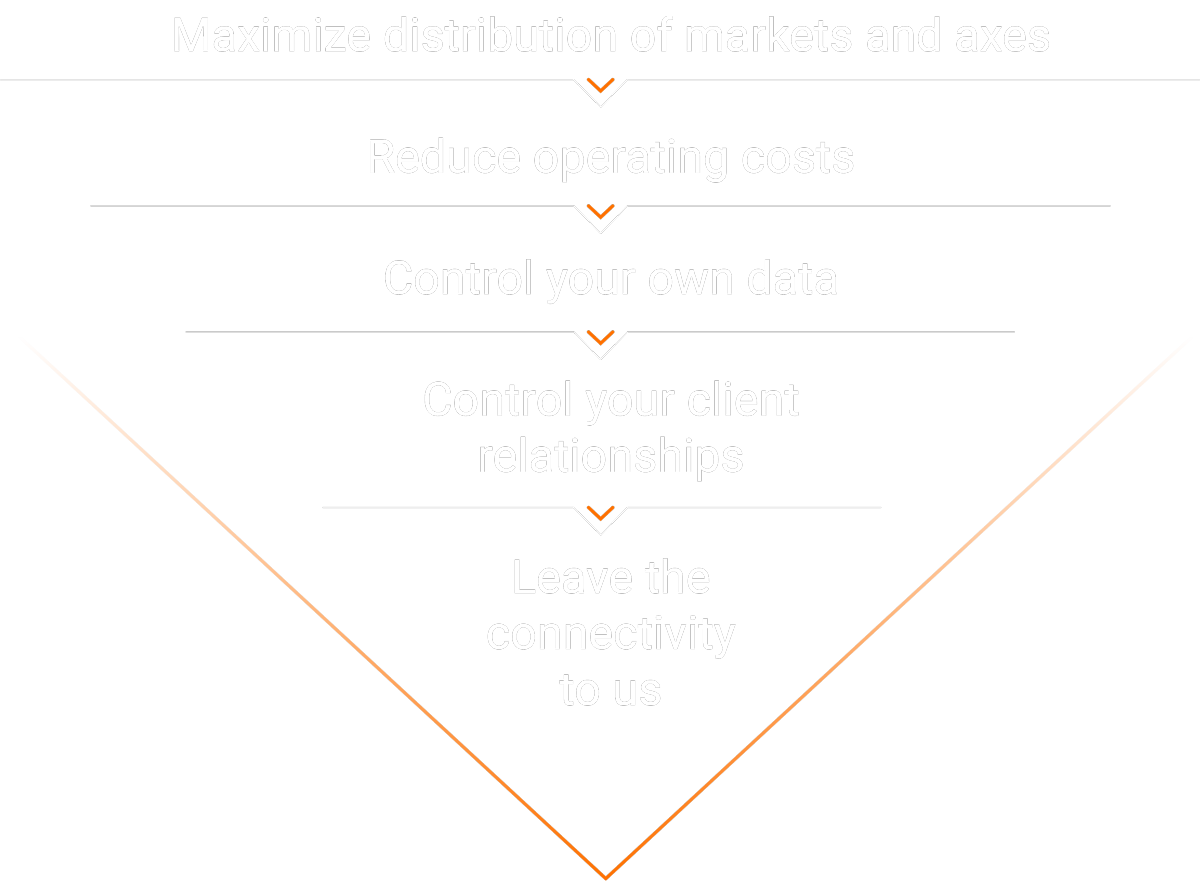

Turnkey Dealer-To-Client Connectivity

Bonds.com has spent 10 years developing market-wide connectivity in the corporate bond space:

- Currently hosting close to 100 streaming liquidity providers and processing over 100 million data points per day

- Dealers can leverage our existing connectivity in a turnkey solution to reach your client base quickly and efficiently

- Lower time to market – a simple solution for establishing direct connectivity with your top clients while maintaining ultimate flexibility

- Point-to-point connectivity for price streaming, axes, and post-trade STP